[ad_1]

Bhubaneswar: In a jolt to the Opposition BJP, the celebration’s Odisha Unit Vice-President Lekhasri Samantasinghar on Sunday resigned from the saffron celebration and joined the Biju Janata Dal (BJD) forward of the Lok Sabha and state Meeting elections.

Lekhasri is the second BJP Odisha vice-president after Bhrugu Baxipatra to resign from the BJP weeks earlier than the polls and be part of the BJD.

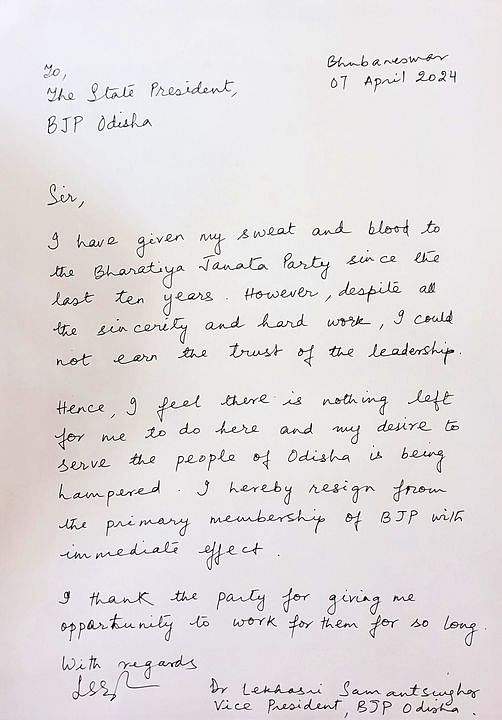

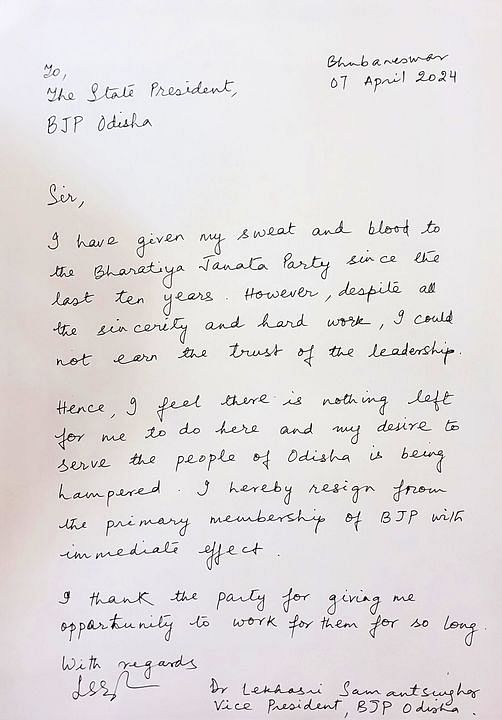

In her resignation letter to Odisha BJP president Manmohan Samal, Lekhasri mentioned that she determined to stop the saffron celebration having ‘failed’ to earn the belief of the management.

Image of Lekhasri Samantsinghar’s resignation letter.

Credit score: Fb/Dr.Lekhasri Samantsinghar

“I’ve given my sweat and blood to the Bharatiya Janata Occasion for the final ten years. Nonetheless, regardless of all of the sincerity and onerous work, I couldn’t earn the belief of the management. Therefore, I really feel there’s nothing left for me to do right here and my want to serve the individuals of Odisha is being hampered,” Lekhasri mentioned within the letter.

Lekhasri on Sunday joined the BJD in presence of celebration MPs Manas Mangaraj and Sasmit Patra.

“It’s troublesome to vary after sweating for a celebration that didn’t recognise my onerous work. I thank BJD for accepting me. I’m impressed by the developmental actions of chief minister Naveen Patnaik. I’ll do my greatest for the BJD,” she instructed reporters after becoming a member of the regional celebration at ‘Sankha Bhavan’, the BJD state headquarters.

Since BJD has but to announce the title of its candidate from the Balasore Lok Sabha seat, she could strive for a ticket to the Balasore Lok Sabha seat.

The BJD in 2019 had fielded seven girls candidates for the 21 Lok Sabha seats within the state. Nonetheless, this time, the celebration has nominated solely six girls candidates to date.

(Revealed 07 April 2024, 07:28 IST)

[ad_2]

Source link