[ad_1]

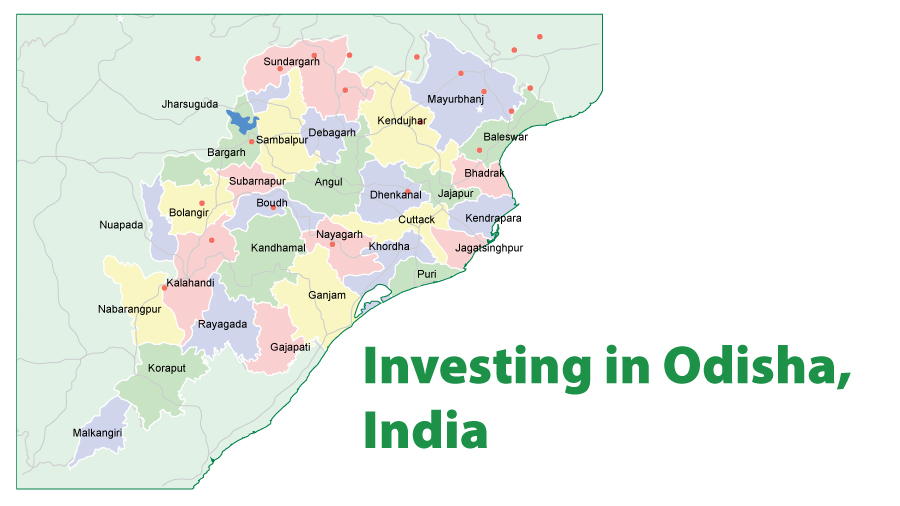

Odisha is a coastal state located within the japanese a part of India with a shoreline of 480km. It’s bounded by the Bay of Bengal on the east, Chhattisgarh state on the west, and Andhra Pradesh state to the south.

Given the state is properly related to main commerce and manufacturing hubs in Asia, the Odisha authorities pitches the state as a gateway to the ASEAN area. Odisha hosts the Paradip port, japanese India’s largest port, which connects the state to Southeast Asian markets.

Odisha possesses important mineral reserves, together with 28 p.c of India’s iron ore, 24 p.c of its coal, 59 p.c of bauxite, and 98 p.c of chromite deposits. This abundance of assets has drawn the curiosity of quite a few mining and metallurgical corporations.

Financial profile of Odisha

The sector-wise contribution to Odisha’s economic system was estimated to be 29 p.c for the agriculture sector, 31 p.c for the manufacturing sector, and 40 p.c for the providers sector in 2021-22, at present costs.

Mineral sector

Odisha possesses a particular benefit in attractive investments in ancillary and downstream metallic industries. A resource-rich coastal state in India, Odisha holds the excellence of getting the very best mineral manufacturing within the nation.

The state authorities has taken proactive measures to draw extra investments. In 2023, it launched the Long Term Linkage (LTL) policy. The coverage is providing long-term ore linkages for iron ore, chrome, bauxite, and limestone produced by the Odisha Mineral Company (OMC). This linkage will likely be out there to buyers establishing end-use vegetation, with provisions for greenfield or growth initiatives, no matter whether or not they have mechanized evacuation programs.

A number of firms have made important investments in Odisha, with one of the notable being the JSW Group. They’re at present within the course of of building an built-in metal manufacturing advanced in Paradip, Odisha, with an estimated funding of INR 650 billion (US$ 7.84 billion). Others who’re investing are the Kalyani group, ArcelorMittal Nippon Metal (AMNS), and so forth.

Meals processing sector

Odisha stands out as one among India’s agriculturally wealthy states, famend for its plentiful manufacturing of fruits, rice, pulses, and different main crops. With 363,000 hectares devoted to agriculture and horticulture, this sector continues to increase steadily. The state boasts a thriving poultry {industry}, acknowledged as a major agricultural exercise, alongside promising alternatives for value-added dairy merchandise.

Recognizing the potential in meals processing, Odisha has recognized it as one of many six key focus sectors. To assist this, the state launched an unique Meals Processing Coverage in 2022, providing aggressive incentives to encourage items to determine themselves inside its borders. Benefiting from sturdy logistics infrastructure, together with entry to Paradip and Dhamra ports, Odisha enjoys seamless connectivity to each home and worldwide markets. This strategic benefit has attracted a number of main gamers within the meals processing sector, together with ITC, Coca Cola, Britannia, Parle, Indo-Nissin, Anmol, and Surya Meals, amongst others, who’ve chosen to arrange operations within the state.

As a part of the Central authorities’s initiatives for provide chain modernization, Odisha state has established two Mega Meals Parks. The Mega Meals Parks Mission seeks to create trendy infrastructure for meals processing alongside your complete worth chain from farm to market, with sturdy ahead and backward linkages by a cluster-based strategy.

|

Title of Mega Meals Park |

Date of ultimate approval |

District |

Standing |

|

Odisha Industrial Infra Dev Corp (IDCO) |

November 6, 2015 |

Khordha |

Ongoing |

|

MITS Mega Meals Park Restricted |

April 16, 2012 |

Rayagada |

Accomplished |

Semiconductor sector

Odisha state is working to arrange a semiconductor base, which is at present at an early stage of improvement. To capitalize on the Central authorities’s initiatives geared toward attracting semiconductor producers to the nation, Odisha has launched its personal package deal of incentives to make the proposition extra interesting underneath its Semiconductor Manufacturing and Fabless Policy-2023.

In keeping with the coverage, Silicon, Compound, Show, and Superior Know-how Manufacturing Crops (ATMP) will obtain enticing incentives of 25 p.c, along with the 50 p.c incentive provided by the Authorities of India. Fabless product/IP firms may also take pleasure in a major 20 p.c incentive. Moreover, Odisha will help 25 undergraduate and 25 postgraduate institutes, supporting their analysis and improvement (R&D) actions in addition to capability constructing efforts.

In February 2024, the coverage underwent additional amendments to reinforce the incentives offered to producers. The amendments to fiscal assist mechanisms embody curiosity subvention, Manufacturing Linked Incentives (PLI), and investments in R&D and talent improvement coaching.

- The amended Semiconductor Manufacturing and Fabless Coverage-2023 permits mega initiatives with investments exceeding INR 5 billion to simply entry an higher restrict of INR 250 million per 12 months for 7 years in the direction of curiosity subsidy. The earlier 5 p.c cap on curiosity subvention has been eliminated.

- Moreover, these mega initiatives are eligible for reimbursement of R&D bills as much as INR 20 million yearly for a decade.

- Relating to the PLI incentive, all items can now apply for the inducement for a steady interval of 5 years throughout the preliminary 7-year manufacturing interval.

- By way of talent improvement, eligible items will obtain reimbursement of as much as INR 20 million per 12 months for five years to assist the coaching of their core operations staff.

Textile sector

Lately, Odisha has grow to be a key heart for textile manufacturing in japanese India. This improvement is credited to the supportive insurance policies enacted by the state authorities, which have drawn important attire and textile firms reminiscent of Welspun, whereas additionally producing curiosity from entities like Mas Holding to make substantial investments within the sector.

In an effort to draw producers to the area, the Odisha authorities launched the Apparel and Technical Textile Policy 2022, which presents a variety of incentives and measures geared toward selling funding and growth within the sector, together with:

- Capital Funding Subsidy: Eligible new industrial items can obtain a 40 p.c capital funding subsidy on precise funding made in Plant & Equipment, as much as a most of INR 500 million, disbursed over a interval of 5 years.

- Employment Price Subsidy: New industrial items are eligible for subsidies on employment prices, offering INR 6000 per feminine employee and INR 5000 per male employee monthly for a interval of 5 years.

- Market Growth Initiative: Reimbursement of fifty p.c of the particular value incurred for taking part in home and worldwide exhibitions/commerce occasions, capped at INR 300,000 per unit for home occasions and INR 600,000 per unit for worldwide occasions.

- Setting-Pleasant Infrastructure Incentives: Advantages as per the Industrial Coverage Decision (IPR) 2022.

IT sector

Odisha is positioning itself as an rising base within the IT sector. The state hosts main IT firms – Infosys, TCS, IBM, and Tech Mahindra have arrange in capital Bhubaneswar. Moreover, initiatives such because the institution of IT parks, personalized incentives for IT firms, and industry-friendly insurance policies are cumulatively making a conducive surroundings for IT corporations.

The introduction of the Odisha IT Policy 2022, with aggressive incentives and a concentrate on cutting-edge applied sciences like synthetic intelligence and cloud computing, additional enhances the state’s attractiveness as an IT vacation spot. Furthermore, the state’s dedication to talent improvement, exemplified by initiatives just like the Nutana Unnata Abhilasha (NUA) Odisha Scheme, underscores its focus to making ready a talented workforce.

Investor facilitation in Odisha

The Odisha Industrial Policy Resolution 2022 is a key coverage initiative geared toward positioning the state as a number one industrial heart in Japanese India. This flagship doc outlines the state authorities’s imaginative and prescient for industrial transformation and highlights precedence and thrust sectors in Odisha that can obtain centered consideration and incentives, each fiscal and non-fiscal, to spur progress and improvement.

|

Odisha Industrial Coverage Decision 2022: Basic provisions |

|

|

Employment technology subsidy |

one hundred pc reimbursement in new industrial items in Precedence and Thrust Sectors for a interval of 5-7 years. |

|

Stamp responsibility exemption |

one hundred pc Exemption |

|

Electrical responsibility exemption |

one hundred pc Exemptions for 7-10 years in precedence and thrust sector |

|

State items and providers tax (SGST) reimbursement |

one hundred pc reimbursement, restricted to 200 p.c of the price of plant and equipment for precedence and thrust sector |

|

Funding subsidy |

20 p.c (Precedence Sector) or 30 p.c (Thrust Sector) capital funding subsidy, disbursed over 5 years |

|

Land incentive |

Allocation of land in industrial areas at concessional industrial charges by IDCO. one hundred pc exemption from cost of premium on land registration. New industrial items in Thrust Sectors, producing over 1000 jobs for state residents, qualify for land at 50 p.c of the economic charge (excluding BDA and CDA). |

Odisha has carried out business-friendly reforms to reinforce the state’s enterprise surroundings. This consists of the institution of Go Swift, a Single Window Clearance system as mandated by the Odisha Industries (Facilitation) Act 2004, with the purpose of simplifying the method for acquiring approvals and clearances for industrial initiatives. To implement this, a web-based Mixed Software Type (CAF) has been launched, which all related departments and authorities are obligated to just accept and deal with.

The federal government has additionally created Funding Facilitation Cells at each the state and district ranges as a part of its efforts to enhance the funding local weather and assist industrial improvement. These cells, working underneath Industrial Promotion and Funding Company of Odisha (IPICOL) on the state degree and District Industries Facilities (DICs) on the district degree, purpose to facilitate land allotment and approvals, guaranteeing well timed processing of functions, conducting consciousness packages for buyers, and following up on approvals inside specified timelines.

With inputs from Melissa Cyrill.

About Us

India Briefing is one among 5 regional publications underneath the Asia Briefing model. It’s supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary skilled providers agency that assists overseas buyers all through Asia, together with by places of work in Delhi, Mumbai, and Bengaluru in India. Readers could write to [email protected] for assist on doing enterprise in India. For a complimentary subscription to India Briefing’s content material merchandise, please click on here.

Dezan Shira & Associates additionally maintains places of work or has alliance companions helping overseas buyers in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Vietnam, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

[ad_2]

Source link