[ad_1]

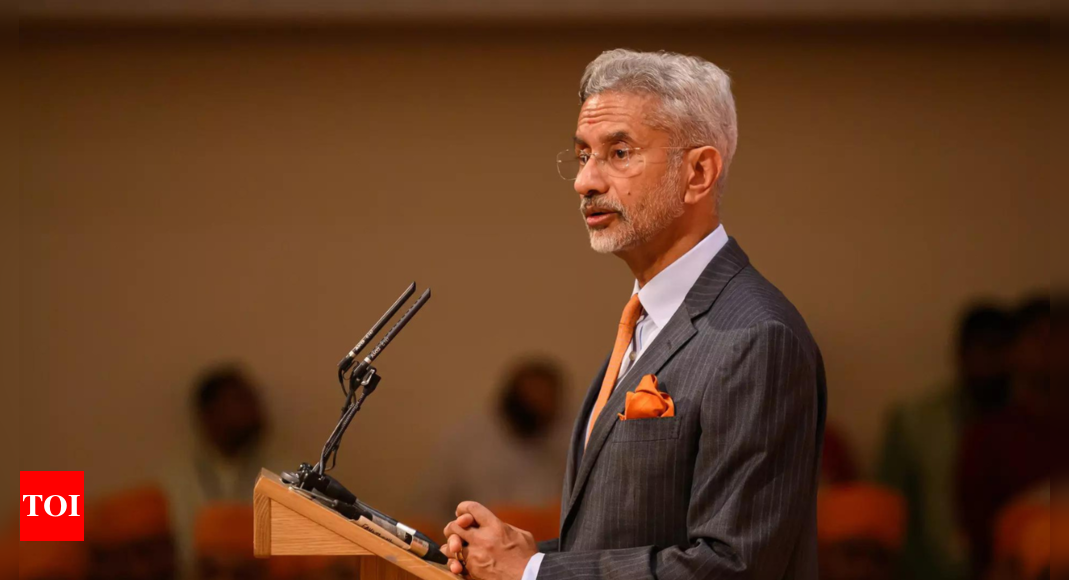

NEW DELHI: Overseas minister S Jaishankar on Tuesday suggested different nations to chorus from making political statements on India’s inner affairs or else will get a ‘very sturdy reply’ from India.

Responding to a query in regards to the latest feedback of US and German envoys on Delhi chief minister Arvind Kejriwal’s arrest the Enforcement Directorate, the international minister stated that India had made it very clear that it objected to such statements.

“Anyone requested an individual from the UN (about Kejriwal’s arrest), and he gave some reply. However in different circumstances, I’d say very frankly these are previous habits, these are dangerous habits,” Jaishankar stated.

“There’s a sure ‘maryada’ (restraint) amongst nations. We’re sovereign nations, we shouldn’t be interfering in one another’s inner affairs, we shouldn’t be passing feedback about one another’s politics,” he added.

The international minister additional stated that sure etiquettes, conventions and practices which have to be adopted in worldwide relations and if any nation feedback in India’s politics, they’ll get a really sturdy reply from the federal government.

“We sincerely urge all of the nations on the planet that by all means you might have your views in regards to the world, however no nation has the correct to touch upon one other nation’s politics particularly in conditions like this,” Jaishankar stated.

Through the interplay, Jaishankar additionally slammed China’s motion of issuing an inventory of recent names for locations in Arunachal Pradesh and referred to as it ‘mindless’. He additionally added that the northeastern state is and can at all times be part of India.

“I wish to be very clear that Arunachal Pradesh was, Arunachal Pradesh is, Arunachal Pradesh will at all times be India. I hope I’m saying it so clearly that not solely within the nation however past the nation additionally individuals get that message very very clearly,” he stated.

In the meantime, Jaishankar additionally got here down closely on Congress chief P Chidambram over the Katchatheevu island row. the EAM stated that the fishermen of Tamil Nadu ought to know who put them on this scenario.

In his tweets on X earlier, Chidambaram stated any “untruthful and belligerent” assertion in regards to the island will carry the Sri Lankan authorities and 35 lakh Tamils into confrontation. Jaishankar did a “somersault” on the difficulty, and as soon as a liberal international service officer, he turned a mouthpiece of the RSS-BJP, the previous Union minister stated.

Jaishankar stated he didn’t thoughts individuals disputing his statements that then prime ministers Jawaharlal Nehru and Indira Gandhi gave no significance to the island and the authorized opinion relating to negotiating fishing rights with Sri Lanka was disregarded.

“However these are public paperwork. By saying that at the moment Jaishankar is in BJP or not — Jaishankar is in BJP and is proud to be in BJP — doesn’t change something. Info are info, reality is reality. Fishermen of Tamil Nadu ought to know who has put them in that scenario,” he stated.

The problem just isn’t what was the (then) authorities’s place… the difficulty is the general public ought to know that the DMK was complicit in it,” he added.

Responding to a query in regards to the latest feedback of US and German envoys on Delhi chief minister Arvind Kejriwal’s arrest the Enforcement Directorate, the international minister stated that India had made it very clear that it objected to such statements.

“Anyone requested an individual from the UN (about Kejriwal’s arrest), and he gave some reply. However in different circumstances, I’d say very frankly these are previous habits, these are dangerous habits,” Jaishankar stated.

“There’s a sure ‘maryada’ (restraint) amongst nations. We’re sovereign nations, we shouldn’t be interfering in one another’s inner affairs, we shouldn’t be passing feedback about one another’s politics,” he added.

The international minister additional stated that sure etiquettes, conventions and practices which have to be adopted in worldwide relations and if any nation feedback in India’s politics, they’ll get a really sturdy reply from the federal government.

“We sincerely urge all of the nations on the planet that by all means you might have your views in regards to the world, however no nation has the correct to touch upon one other nation’s politics particularly in conditions like this,” Jaishankar stated.

Through the interplay, Jaishankar additionally slammed China’s motion of issuing an inventory of recent names for locations in Arunachal Pradesh and referred to as it ‘mindless’. He additionally added that the northeastern state is and can at all times be part of India.

“I wish to be very clear that Arunachal Pradesh was, Arunachal Pradesh is, Arunachal Pradesh will at all times be India. I hope I’m saying it so clearly that not solely within the nation however past the nation additionally individuals get that message very very clearly,” he stated.

In the meantime, Jaishankar additionally got here down closely on Congress chief P Chidambram over the Katchatheevu island row. the EAM stated that the fishermen of Tamil Nadu ought to know who put them on this scenario.

In his tweets on X earlier, Chidambaram stated any “untruthful and belligerent” assertion in regards to the island will carry the Sri Lankan authorities and 35 lakh Tamils into confrontation. Jaishankar did a “somersault” on the difficulty, and as soon as a liberal international service officer, he turned a mouthpiece of the RSS-BJP, the previous Union minister stated.

Jaishankar stated he didn’t thoughts individuals disputing his statements that then prime ministers Jawaharlal Nehru and Indira Gandhi gave no significance to the island and the authorized opinion relating to negotiating fishing rights with Sri Lanka was disregarded.

“However these are public paperwork. By saying that at the moment Jaishankar is in BJP or not — Jaishankar is in BJP and is proud to be in BJP — doesn’t change something. Info are info, reality is reality. Fishermen of Tamil Nadu ought to know who has put them in that scenario,” he stated.

The problem just isn’t what was the (then) authorities’s place… the difficulty is the general public ought to know that the DMK was complicit in it,” he added.

[ad_2]

Source link