[ad_1]

Detection Know-how Oyj (HEL:DETEC) inventory is about to commerce ex-dividend in 3 days. The ex-dividend date is one enterprise day earlier than an organization’s file date, which is the date on which the corporate determines which shareholders are entitled to obtain a dividend. You will need to concentrate on the ex-dividend date as a result of any commerce on the inventory must have been settled on or earlier than the file date. In different phrases, traders should buy Detection Know-how Oyj’s shares earlier than the twenty eighth of March with a purpose to be eligible for the dividend, which shall be paid on the ninth of April.

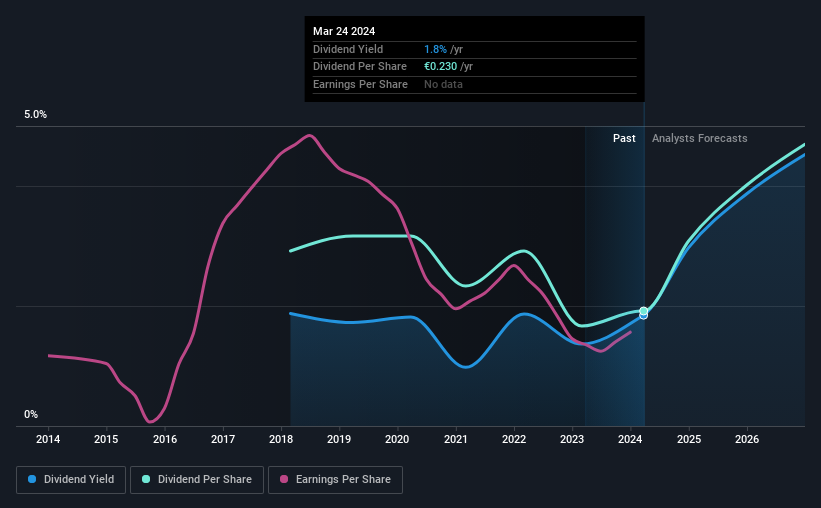

The corporate’s upcoming dividend is €0.23 a share, following on from the final 12 months, when the corporate distributed a complete of €0.23 per share to shareholders. Calculating the final yr’s value of funds exhibits that Detection Know-how Oyj has a trailing yield of 1.8% on the present share worth of €12.45. If you happen to purchase this enterprise for its dividend, it is best to have an thought of whether or not Detection Know-how Oyj’s dividend is dependable and sustainable. That is why we must always all the time test whether or not the dividend funds seem sustainable, and if the corporate is rising.

Check out our latest analysis for Detection Technology Oyj

Dividends are often paid out of firm income, so if an organization pays out greater than it earned then its dividend is often at higher danger of being reduce. Detection Know-how Oyj paid out 61% of its earnings to traders final yr, a standard payout stage for many companies. That stated, even extremely worthwhile corporations typically won’t generate sufficient money to pay the dividend, which is why we must always all the time test if the dividend is roofed by money circulate. Fortunately its dividend funds took up simply 39% of the free money circulate it generated, which is a snug payout ratio.

It is encouraging to see that the dividend is roofed by each revenue and money circulate. This usually suggests the dividend is sustainable, so long as earnings do not drop precipitously.

Click on here to see the company’s payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Rising?

Companies with shrinking earnings are tough from a dividend perspective. Buyers love dividends, so if earnings fall and the dividend is diminished, count on a inventory to be offered off closely on the similar time. Detection Know-how Oyj’s earnings per share have fallen at roughly 18% a yr over the earlier 5 years. In the end, when earnings per share decline, the scale of the pie from which dividends may be paid, shrinks.

One other key technique to measure an organization’s dividend prospects is by measuring its historic fee of dividend development. Detection Know-how Oyj’s dividend funds per share have declined at 6.8% per yr on common over the previous six years, which is uninspiring. Whereas it is not nice that earnings and dividends per share have fallen lately, we’re inspired by the truth that administration has trimmed the dividend relatively than danger over-committing the corporate in a dangerous try to keep up yields to shareholders.

The Backside Line

Is Detection Know-how Oyj a beautiful dividend inventory, or higher left on the shelf? We’re not enthused by the declining earnings per share, though at the least the corporate’s payout ratio is inside an affordable vary, which means it might not be at imminent danger of a dividend reduce. In abstract, whereas it has some optimistic traits, we’re not inclined to race out and purchase Detection Know-how Oyj as we speak.

Curious what different traders consider Detection Know-how Oyj? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

Typically, we would not suggest simply shopping for the primary dividend inventory you see. This is a curated list of interesting stocks that are strong dividend payers.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Detection Know-how Oyj is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link