[ad_1]

Micron Expertise (NASDAQ: MU) wowed buyers final week with an excellent set of outcomes for the second quarter of its fiscal 2024, reporting a large leap in its income and a shock revenue, and this despatched shares of the reminiscence specialist hovering.

The chipmaker benefited from a jump in demand for memory chipsr. Consequently, its income elevated a large 58% yr over yr to $5.8 billion. Micron is anticipating stronger year-over-year progress of 76% in its high line within the present quarter, pushed by elevated urge for food for reminiscence chips from artificial intelligence (AI) servers, smartphones, and private computer systems (PCs).

The reminiscence business has witnessed a big turnaround of late as demand for client electronics is again on observe, whereas AI has created the necessity for superior reminiscence chips often known as high-bandwidth reminiscence (HBM). Micron administration remarked on the most recent earnings-conference name that its HBM capability for 2024 is offered out, whereas the “overwhelming majority of our 2025 provide has already been allotted.”

That is excellent news for Lam Analysis (NASDAQ: LRCX), a semiconductor gear producer that will get an enormous chunk of its income from promoting its items to reminiscence producers comparable to Micron. Let’s take a look at the the reason why Micron’s newest outcomes are a sign that buyers would do nicely to purchase Lam Analysis inventory proper now.

Lam Analysis is about to witness a strong turnaround

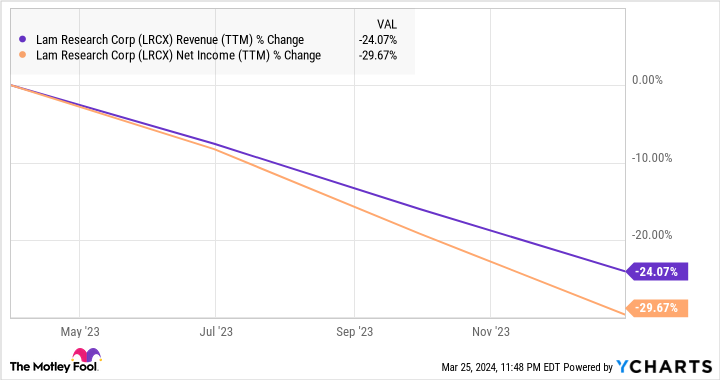

In the newest quarter, Lam Analysis received 48% of its income from promoting semiconductor manufacturing gear to reminiscence producers. This explains why the corporate’s leads to latest quarters have been poor. An oversupply within the reminiscence market pressured the likes of Micron and others to place a maintain on capability enlargement, and so Lam’s high and backside strains have been heading south.

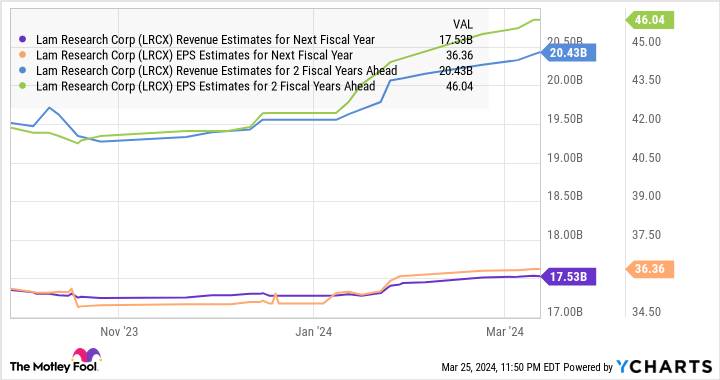

Analysts count on the corporate to complete the present fiscal yr with a 22% decline in income to $13.6 billion. Moreover, earnings are anticipated to drop to $26.76 per share from $34.16. Nevertheless, as the next chart exhibits, Lam Analysis’s income and earnings may leap sharply within the subsequent fiscal yr, which can start on the finish of June 2024.

Micron’s newest outcomes and administration commentary inform us simply why Lam’s fortunes are set to show round. Reminiscence makers might want to enhance their provide of HBM to cater to the rising demand from AI servers. The nice half is that Lam is already witnessing strong orders for HBM gear. CEO Tim Archer identified on the corporate’s January convention name with analysts: “In 2024, we count on our HBM-related DRAM and packaging shipments to greater than triple yr on yr… “

It is usually price noting that the general reminiscence market is about to leap large time in 2024. In accordance with Gartner, the reminiscence business’s income may leap 66% this yr following a 39% drop in 2023. Extra importantly, the rising adoption of AI is about to drive sturdy long-term reminiscence demand.

In accordance with Micron, AI-enabled PCs are more likely to carry 40% to 80% extra DRAM (dynamic random entry reminiscence) content material when in comparison with conventional PCs. Then again, the corporate expects AI-capable smartphones to “carry 50% to 100% higher DRAM content material in comparison with non-AI flagship telephones at this time.”

In the meantime, the demand for HBM is forecast to greater than double in 2024, producing $14 billion in income as in comparison with $5.5 billion final yr. Even higher, the HBM market may generate nearly $20 billion in income subsequent yr. All this means that reminiscence producers should ramp up their manufacturing capacities, and a more in-depth have a look at the business signifies that is simply what’s occurring.

Samsung, for instance, is anticipated to extend HBM manufacturing by 2.5 instances in 2024, adopted by a 2x enhance subsequent yr. Equally, SK Hynix expects to extend its capital expenditure this yr to assist rising HBM demand. As such, the end-market circumstances are set to show favorable for Lam Analysis.

Shopping for the inventory is a no brainer proper now

Lam Analysis is presently buying and selling at 27 instances ahead earnings estimates. That is a small low cost to the Nasdaq-100‘s common a number of of 28 (utilizing the index as a proxy for tech shares). If Lam Analysis’s earnings hit the $46 estimate, and it had been to commerce at 28 instances earnings, that might put its inventory at $1,288, a 33% leap from its present value.

Nevertheless, do not be stunned to see the inventory delivering stronger good points because the market could reward it with the next earnings a number of due to its AI-fueled progress, which is why buyers ought to think about shopping for this semiconductor inventory earlier than it jumps larger.

Must you make investments $1,000 in Lam Analysis proper now?

Before you purchase inventory in Lam Analysis, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Lam Analysis wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 25, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Lam Analysis. The Motley Idiot recommends Gartner. The Motley Idiot has a disclosure policy.

1 Semiconductor Stock to Buy Hand Over Fist After Micron Technology’s Stellar Report was initially revealed by The Motley Idiot

[ad_2]

Source link