[ad_1]

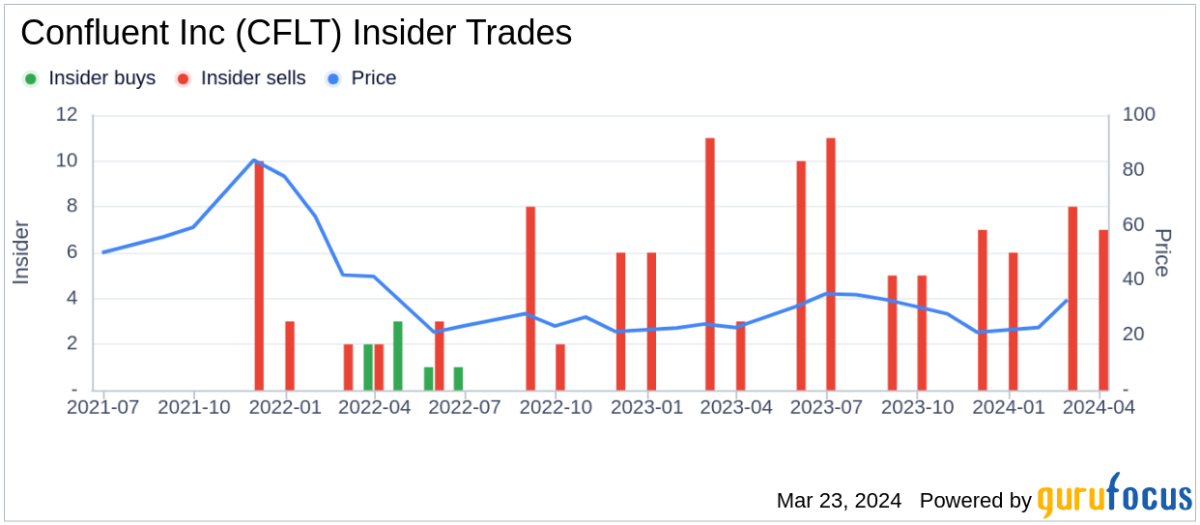

Confluent Inc (NASDAQ:CFLT), an organization specializing in real-time information streaming options, has reported an insider sale in keeping with a latest SEC submitting. Chief Expertise Officer Chad Verbowski bought 8,086 shares of the corporate on March 20, 2024.Chad Verbowski has been lively available in the market over the previous 12 months, promoting a complete of 65,253 shares and buying none. This newest transaction continues the development of insider gross sales at Confluent Inc, with a complete of 59 insider sells and no insider buys over the previous 12 months.

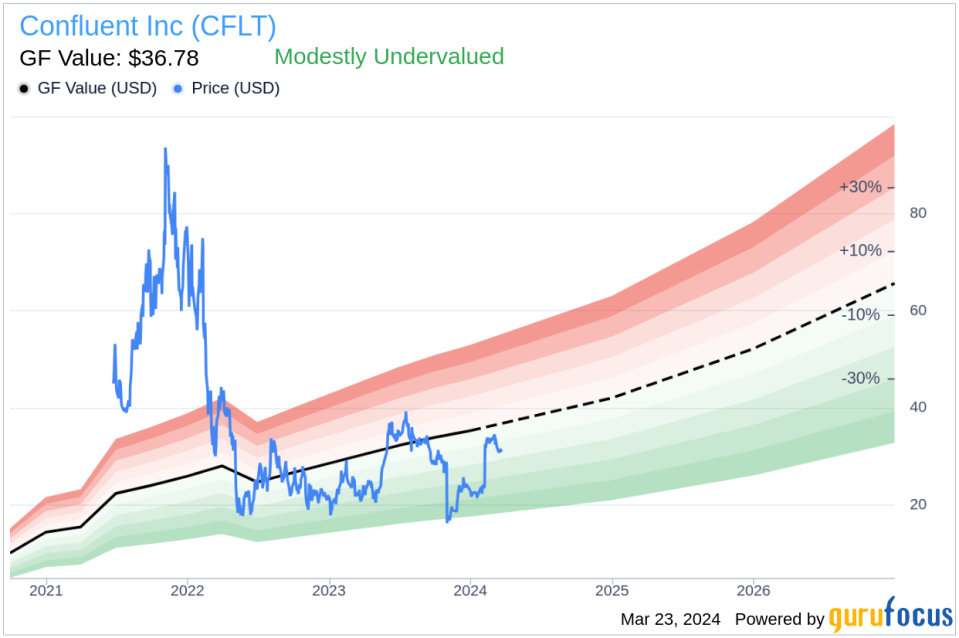

On the day of the sale, shares of Confluent Inc have been buying and selling at $31.2, giving the corporate a market capitalization of $9.674 billion. The inventory’s price-to-GF-Worth ratio stands at 0.85, indicating that it’s modestly undervalued in keeping with the GF Worth metric.

The GF Worth is a proprietary intrinsic worth estimate from GuruFocus, which components in historic buying and selling multiples, a GuruFocus adjustment issue primarily based on previous returns and development, and future enterprise efficiency estimates from Morningstar analysts.For extra data on the insider buying and selling at Confluent Inc, together with detailed transaction historical past, go to the corporate’s SEC filings.

This text, generated by GuruFocus, is designed to offer normal insights and isn’t tailor-made monetary recommendation. Our commentary is rooted in historic information and analyst projections, using an neutral methodology, and isn’t supposed to function particular funding steerage. It doesn’t formulate a suggestion to buy or divest any inventory and doesn’t take into account particular person funding goals or monetary circumstances. Our goal is to ship long-term, elementary data-driven evaluation. Bear in mind that our evaluation may not incorporate the newest, price-sensitive firm bulletins or qualitative data. GuruFocus holds no place within the shares talked about herein.

This text first appeared on GuruFocus.

[ad_2]

Source link