In right now’s fast-paced world, digital transformation isn’t only a development; it has change into key for survival. The banking sector now stands at a crossroads the place embracing cloud-based platforms and collaborating with specialised third events isn’t just an possibility, however a necessity.

Banks usually change into slowed down with legacy programs that hinder development and change into a legal responsibility. The way in which ahead for the banking sector is undoubtedly to be in digitalisation and cloud applied sciences, based on a whitepaper from innovation consultancy Zühlke Group.

This shift within the banking sector in the direction of new applied sciences allows data-driven decision-making and personalised buyer experiences, amongst different advantages important for enhancing engagement and loyalty.

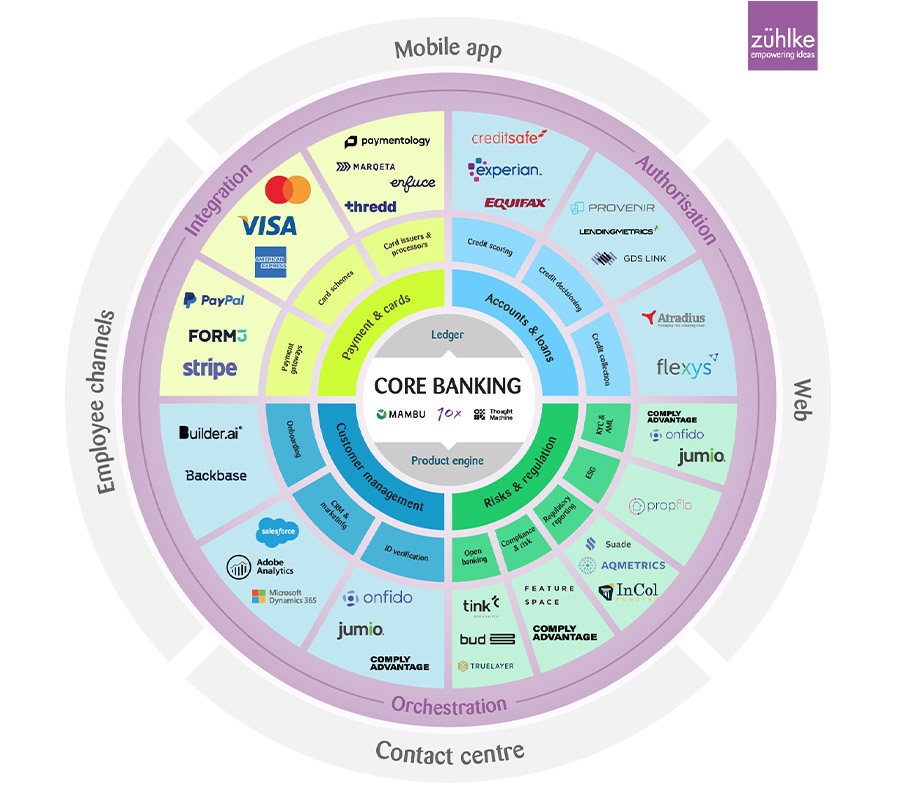

One necessary manner that banks are innovating is throughout the framework of ‘monetary providers ecosystems’. That refers to collaboration fashions between totally different monetary establishments whereby every is ready to leverage their distinct and complementary choices. This will help to supply extra seamless buyer experiences.

“A well-functioning ecosystem requires a contemporary banking platform that’s, ideally, composed of cloud-based providers. That manner, it might allow the intricate integration and orchestration of product choices and buyer experiences amongst members to make sure safety, integrity, and resilience,” based on Maurice Roach, managing director for Monetary Companies UK at Zühlke.

If conventional banks hope to maintain up with a altering trade, you will need to prioritise new collaborations inside a monetary providers ecosystem. It may possibly assist banks to be extra aggressive, modern, and permits higher integration with third events.

“By leveraging partnerships, new channels, and fashionable know-how options, you’ll be able to handle these challenges and change into extra agile, evolving quicker to satisfy the ever-changing buyer wants. The monetary providers ecosystem permits you to take action most successfully,” mentioned Zühlke Former Principal Enterprise Advisor Rasha Hamdan.

Construct or purchase?

With a purpose to make this leap into innovation and embrace of an ecosystem strategy, step one is to develop a viable technique. Following that, folks and tradition will must be the principle precedence, contemplating massive modifications in any organisation would require good communication, motivation, and readability on finish targets.

Subsequent comes a call on ‘constructing or shopping for’: In different phrases, if the brand new applied sciences and providers to be provided shall be constructed in-house or outsourced to a 3rd social gathering. There are execs and cons to each routes and a few banks could select each shopping for for some components of their enterprise and constructing for others.

Above all, it will likely be necessary within the medium time period for banks to expedite migration to the cloud, as cloud know-how reaches new ranges of maturity and these instruments change into more and more important for enterprise to remain forward of the curve.

“Most conventional banks are presently on a hybrid cloud mannequin or are migrating away from what they’ve on-premises as many perceive the worth of making a robust digital core, accessing API ecosystems, and eliminating costly and cumbersome legacy platforms,” defined Roach.

“Nonetheless, you will need to keep in mind that with the cloud, the fitting strategy is crucial. Similar to some other know-how, cloud implementation and upkeep include challenges.”