[ad_1]

When you’re unsure the place to start out when on the lookout for the following multi-bagger, there are a couple of key tendencies you must preserve an eye fixed out for. Amongst different issues, we’ll wish to see two issues; firstly, a rising return on capital employed (ROCE) and secondly, an growth within the firm’s quantity of capital employed. Principally which means that an organization has worthwhile initiatives that it could possibly proceed to reinvest in, which is a trait of a compounding machine. So on that word, ES Ceramics Know-how Berhad (KLSE:ESCERAM) seems to be fairly promising with reference to its tendencies of return on capital.

What Is Return On Capital Employed (ROCE)?

For individuals who do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. Analysts use this system to calculate it for ES Ceramics Know-how Berhad:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Property – Present Liabilities)

0.11 = RM25m ÷ (RM327m – RM102m) (Primarily based on the trailing twelve months to November 2023).

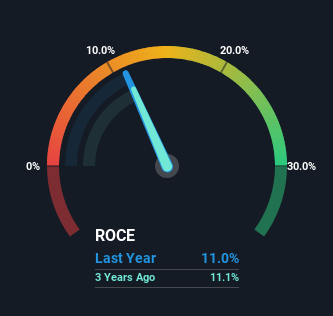

Subsequently, ES Ceramics Know-how Berhad has an ROCE of 11%. In absolute phrases, that is a passable return, however in comparison with the Constructing business common of 8.8% it is significantly better.

Check out our latest analysis for ES Ceramics Technology Berhad

Historic efficiency is a good place to start out when researching a inventory so above you’ll be able to see the gauge for ES Ceramics Know-how Berhad’s ROCE towards it is prior returns. If you would like to take a look at how ES Ceramics Know-how Berhad has carried out previously in different metrics, you’ll be able to view this free graph of ES Ceramics Technology Berhad’s past earnings, revenue and cash flow.

The Pattern Of ROCE

We just like the tendencies that we’re seeing from ES Ceramics Know-how Berhad. During the last 5 years, returns on capital employed have risen considerably to 11%. Principally the enterprise is incomes extra per greenback of capital invested and along with that, 363% extra capital is being employed now too. The growing returns on a rising quantity of capital is frequent amongst multi-baggers and that is why we’re impressed.

For the report although, there was a noticeable enhance within the firm’s present liabilities over the interval, so we might attribute a number of the ROCE progress to that. Successfully which means that suppliers or short-term collectors at the moment are funding 31% of the enterprise, which is greater than it was 5 years in the past. It is price keeping track of this as a result of as the proportion of present liabilities to complete property will increase, some features of danger additionally enhance.

What We Can Study From ES Ceramics Know-how Berhad’s ROCE

All in all, it is terrific to see that ES Ceramics Know-how Berhad is reaping the rewards from prior investments and is rising its capital base. And a outstanding 207% complete return over the past 5 years tells us that buyers expect extra good issues to come back sooner or later. With that being stated, we nonetheless assume the promising fundamentals imply the corporate deserves some additional due diligence.

ES Ceramics Know-how Berhad does have some dangers although, and we have noticed 3 warning signs for ES Ceramics Technology Berhad that you just may be inquisitive about.

Whereas ES Ceramics Know-how Berhad could not at present earn the best returns, we have compiled a listing of corporations that at present earn greater than 25% return on fairness. Try this free list here.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link