[ad_1]

Unveiling the Dividend Dynamics of Worldwide Sport Expertise PLC

Worldwide Sport Expertise PLC (NYSE:IGT) just lately introduced a dividend of $0.2 per share, payable on 2024-04-09, with the ex-dividend date set for 2024-03-25. As traders sit up for this upcoming fee, the highlight additionally shines on the corporate’s dividend historical past, yield, and development charges. Utilizing the information from GuruFocus, let’s look into Worldwide Sport Expertise PLC’s dividend efficiency and assess its sustainability.

What Does Worldwide Sport Expertise PLC Do?

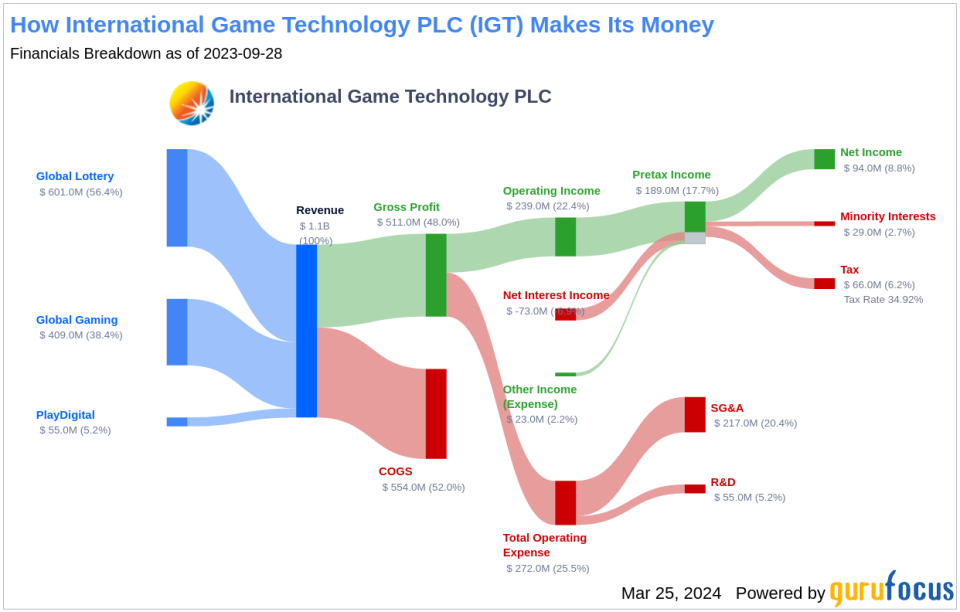

Worldwide Sport Expertise PLC is a gaming firm that delivers entertaining and accountable gaming experiences for gamers throughout all channels. The corporate’s working segments embrace International Lottery, International Gaming, and PlayDigital. It generates most income from the International Lottery section. International Lottery section offers lottery services and products to governmental organizations by way of working contracts, amenities administration contracts, lottery administration agreements, and product gross sales contracts. Geographically, it derives a majority of income from the US.

A Glimpse at Worldwide Sport Expertise PLC’s Dividend Historical past

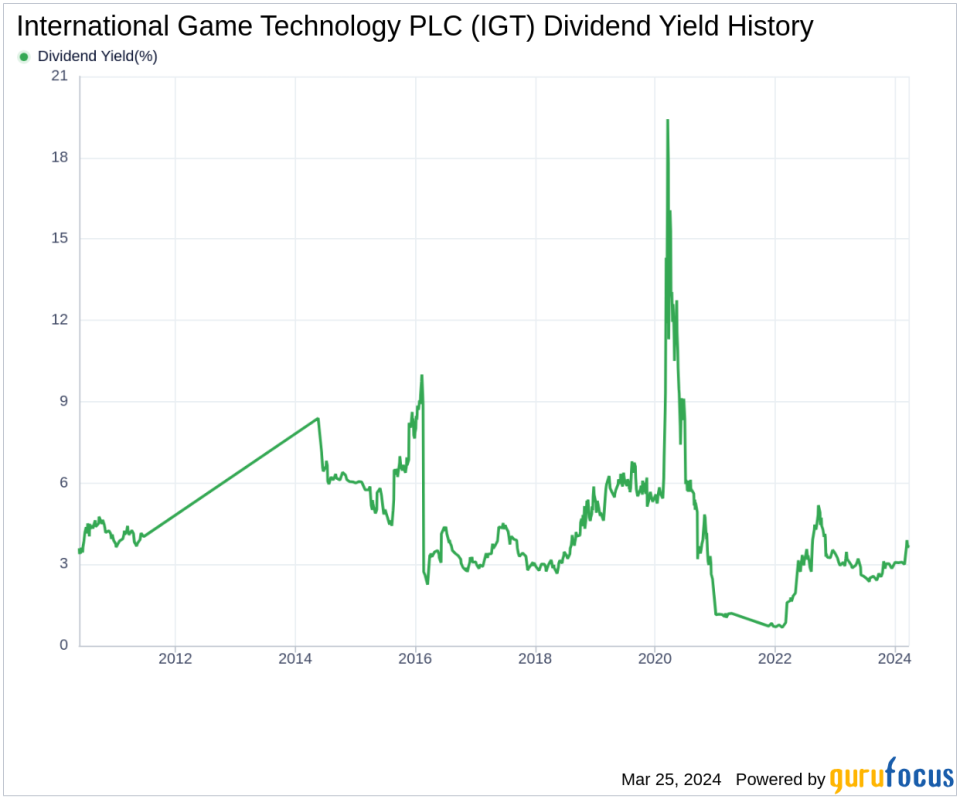

Worldwide Sport Expertise PLC has maintained a constant dividend payment report since 2014. Dividends are at present distributed on a quarterly foundation. Beneath is a chart exhibiting annual Dividends Per Share for monitoring historic traits.

Breaking Down Worldwide Sport Expertise PLC’s Dividend Yield and Progress

As of at this time, Worldwide Sport Expertise PLC at present has a 12-month trailing dividend yield of three.71% and a 12-month forward dividend yield of three.71%. This means an expectation of similar dividend funds over the subsequent 12 months.

Over the previous three years, Worldwide Sport Expertise PLC’s annual dividend growth rate was 58.70%. Primarily based on Worldwide Sport Expertise PLC’s dividend yield and five-year development fee, the 5-year yield on cost of Worldwide Sport Expertise PLC inventory as of at this time is roughly 3.71%.

The Sustainability Query: Payout Ratio and Profitability

To evaluate the sustainability of the dividend, one wants to judge the corporate’s payout ratio. The dividend payout ratio offers insights into the portion of earnings the corporate distributes as dividends. A decrease ratio means that the corporate retains a major a part of its earnings, thereby guaranteeing the supply of funds for future development and surprising downturns. As of 2023-12-31, Worldwide Sport Expertise PLC’s dividend payout ratio is 0.53.

Worldwide Sport Expertise PLC’s profitability rank, gives an understanding of the corporate’s earnings prowess relative to its friends. GuruFocus ranks Worldwide Sport Expertise PLC’s profitability 6 out of 10 as of 2023-12-31, suggesting truthful profitability. The corporate has reported web revenue in 5 years out of previous 10 years.

Progress Metrics: The Future Outlook

To make sure the sustainability of dividends, an organization should have sturdy development metrics. Worldwide Sport Expertise PLC’s growth rank of 6 out of 10 means that the corporate has a good development outlook. Income is the lifeblood of any firm, and Worldwide Sport Expertise PLC’s revenue per share, mixed with the 3-year revenue growth rate, signifies a powerful income mannequin. Worldwide Sport Expertise PLC’s income has elevated by roughly 11.70% per yr on common, a fee that outperforms roughly 67.18% of world opponents.

Investing in Worldwide Sport Expertise PLC’s Dividend Future

Contemplating Worldwide Sport Expertise PLC’s constant dividend funds, sturdy dividend development fee, wise payout ratio, and truthful profitability and development metrics, traders might discover the inventory to be a lovely possibility for income-focused portfolios. Whereas previous efficiency is indicative, it is also essential to regulate the broader business traits and the corporate’s strategic responses to modifications throughout the gaming sector. Prudent traders ought to proceed to watch Worldwide Sport Expertise PLC’s monetary well being and market place to make sure their funding aligns with their monetary targets.

GuruFocus Premium customers can display screen for high-dividend yield shares utilizing the High Dividend Yield Screener.

This text, generated by GuruFocus, is designed to offer normal insights and isn’t tailor-made monetary recommendation. Our commentary is rooted in historic information and analyst projections, using an neutral methodology, and isn’t supposed to function particular funding steering. It doesn’t formulate a advice to buy or divest any inventory and doesn’t take into account particular person funding targets or monetary circumstances. Our goal is to ship long-term, basic data-driven evaluation. Remember that our evaluation won’t incorporate the newest, price-sensitive firm bulletins or qualitative data. GuruFocus holds no place within the shares talked about herein.

This text first appeared on GuruFocus.

[ad_2]

Source link