Long run investing works properly, but it surely does not all the time work for every particular person inventory. We do not want catastrophic capital loss on anybody. For instance, we sympathize with anybody who was caught holding Inventive Know-how Ltd (SGX:C76) through the 5 years that noticed its share worth drop a whopping 72%. The falls have accelerated lately, with the share worth down 10% within the final three months.

Since shareholders are down over the long run, lets take a look at the underlying fundamentals over the that point and see if they have been in line with returns.

See our latest analysis for Creative Technology

Inventive Know-how is not presently worthwhile, so most analysts would look to income development to get an thought of how briskly the underlying enterprise is rising. Shareholders of unprofitable firms normally need robust income development. As you’ll be able to think about, quick income development, when maintained, usually results in quick revenue development.

Within the final 5 years Inventive Know-how noticed its income shrink by 0.0001% per 12 months. That is not what buyers usually need to see. The share worth fall of 12% (per 12 months, over 5 years) is a stern reminder that money-losing firms are anticipated to develop income. We’re usually averse to firms with declining revenues, however we’re not alone in that. That isn’t actually what the profitable buyers we all know intention for.

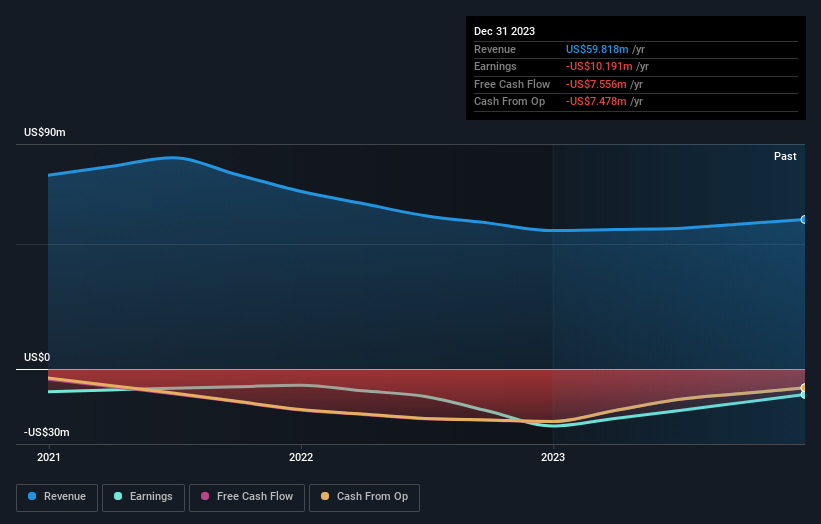

The corporate’s income and earnings (over time) are depicted within the picture under (click on to see the precise numbers).

You may see how its stability sheet has strengthened (or weakened) over time on this free interactive graphic.

A Completely different Perspective

Buyers in Inventive Know-how had a tricky 12 months, with a complete lack of 11%, towards a market acquire of about 1.4%. Nonetheless, remember that even the perfect shares will generally underperform the market over a twelve month interval. Nonetheless, the loss during the last 12 months is not as unhealthy because the 12% every year loss buyers have suffered during the last half decade. We’d need clear data suggesting the corporate will develop, earlier than taking the view that the share worth will stabilize. It is all the time fascinating to trace share worth efficiency over the long run. However to know Inventive Know-how higher, we have to take into account many different components. Living proof: We have noticed 2 warning signs for Creative Technology you need to be conscious of, and 1 of them does not sit too properly with us.

For many who like to search out profitable investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please notice, the market returns quoted on this article replicate the market weighted common returns of shares that presently commerce on Singaporean exchanges.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to convey you long-term targeted evaluation pushed by basic knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.