[ad_1]

Legendary fund supervisor Li Lu (who Charlie Munger backed) as soon as stated, ‘The most important funding threat isn’t the volatility of costs, however whether or not you’ll undergo a everlasting lack of capital.’ It is solely pure to contemplate an organization’s stability sheet if you look at how dangerous it’s, since debt is commonly concerned when a enterprise collapses. As with many different firms Marvell Expertise, Inc. (NASDAQ:MRVL) makes use of debt. However the true query is whether or not this debt is making the corporate dangerous.

Why Does Debt Carry Danger?

Usually talking, debt solely turns into an actual drawback when an organization cannot simply pay it off, both by elevating capital or with its personal money stream. In the end, if the corporate cannot fulfill its authorized obligations to repay debt, shareholders might stroll away with nothing. Nevertheless, a extra typical (however nonetheless costly) state of affairs is the place an organization should dilute shareholders at an inexpensive share worth merely to get debt beneath management. In fact, debt might be an vital device in companies, significantly capital heavy companies. Once we take into consideration an organization’s use of debt, we first take a look at money and debt collectively.

Check out our latest analysis for Marvell Technology

How A lot Debt Does Marvell Expertise Carry?

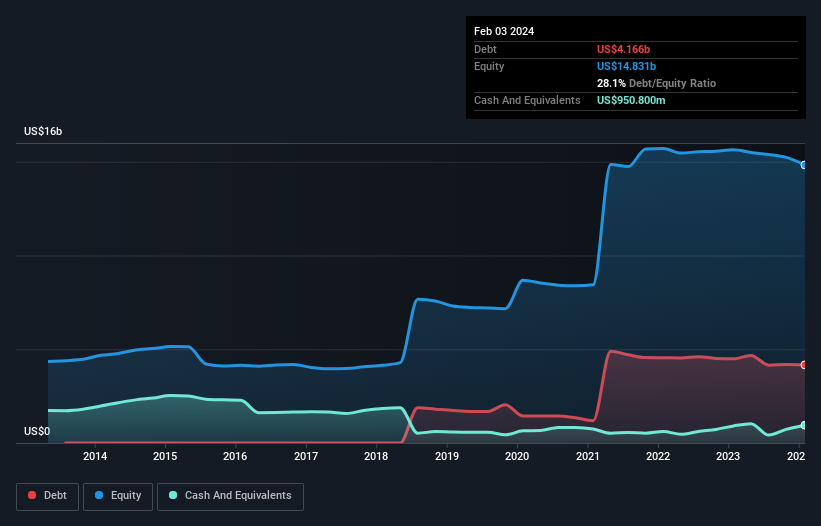

The picture under, which you’ll be able to click on on for larger element, exhibits that Marvell Expertise had debt of US$4.17b on the finish of February 2024, a discount from US$4.49b over a 12 months. Nevertheless, it does have US$950.8m in money offsetting this, resulting in internet debt of about US$3.22b.

How Sturdy Is Marvell Expertise’s Steadiness Sheet?

Zooming in on the newest stability sheet information, we are able to see that Marvell Expertise had liabilities of US$1.81b due inside 12 months and liabilities of US$4.58b due past that. Offsetting this, it had US$950.8m in money and US$1.12b in receivables that had been due inside 12 months. So its liabilities outweigh the sum of its money and (near-term) receivables by US$4.32b.

Given Marvell Expertise has a humongous market capitalization of US$61.4b, it is onerous to consider these liabilities pose a lot risk. Nevertheless, we do suppose it’s price maintaining a tally of its stability sheet power, as it might change over time. There is no doubt that we be taught most about debt from the stability sheet. However it’s future earnings, greater than something, that may decide Marvell Expertise’s capacity to take care of a wholesome stability sheet going ahead. So in the event you’re targeted on the longer term you may take a look at this free report showing analyst profit forecasts.

Over 12 months, Marvell Expertise made a loss on the EBIT degree, and noticed its income drop to US$5.5b, which is a fall of 6.8%. That is not what we might hope to see.

Caveat Emptor

During the last twelve months Marvell Expertise produced an earnings earlier than curiosity and tax (EBIT) loss. Certainly, it misplaced US$437m on the EBIT degree. Contemplating that alongside the liabilities talked about above doesn’t give us a lot confidence that firm must be utilizing a lot debt. So we expect its stability sheet is a bit strained, although not past restore. For instance, we might not wish to see a repeat of final 12 months’s lack of US$933m. So we do suppose this inventory is sort of dangerous. For riskier firms like Marvell Expertise I all the time prefer to control whether or not insiders are shopping for or promoting. So click here if you want to find out for yourself.

In fact, in the event you’re the kind of investor who prefers shopping for shares with out the burden of debt, then do not hesitate to find our exclusive list of net cash growth stocks, right now.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Marvell Expertise is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to convey you long-term targeted evaluation pushed by elementary information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link