Let’s dig into the relative efficiency of Microchip Know-how (NASDAQ:MCHP) and its friends as we unravel the now-completed This fall analog semiconductors earnings season.

Demand for analog chips is usually linked to the general stage of financial progress, as analog chips function the constructing blocks of most digital items and tools. In contrast to digital chip designers, analog chip makers have a tendency to supply nearly all of their very own chips, as analog chip manufacturing doesn’t require costly forefront nodes. Much less depending on main secular progress drivers, analog product cycles are for much longer, typically 5-7 years.

The 15 analog semiconductors shares we monitor reported a weaker This fall; on common, revenues have been according to analyst consensus estimates whereas subsequent quarter’s income steering was 3.6% beneath consensus. Shares have confronted challenges as buyers prioritize near-term money flows, however analog semiconductors shares held their floor higher than others, with the share costs up 0.8% on common because the earlier earnings outcomes.

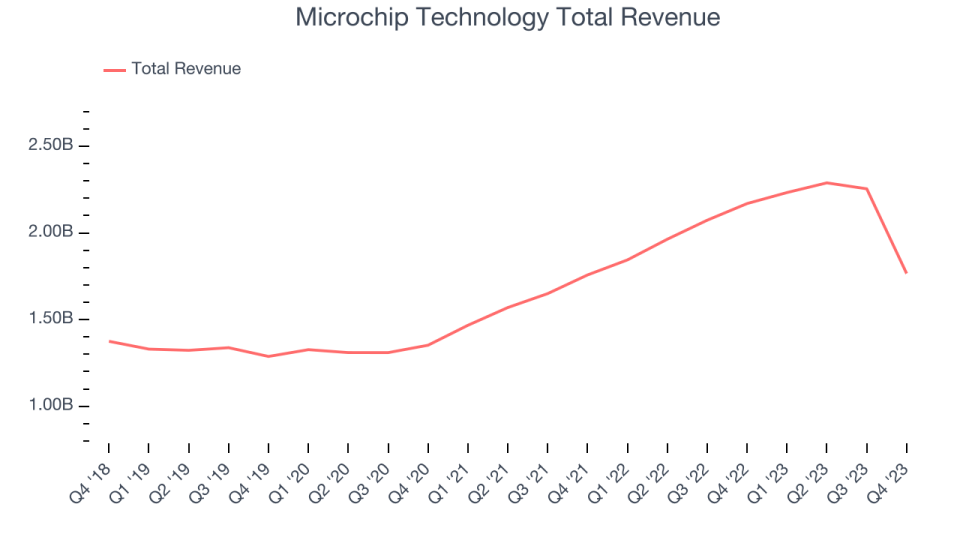

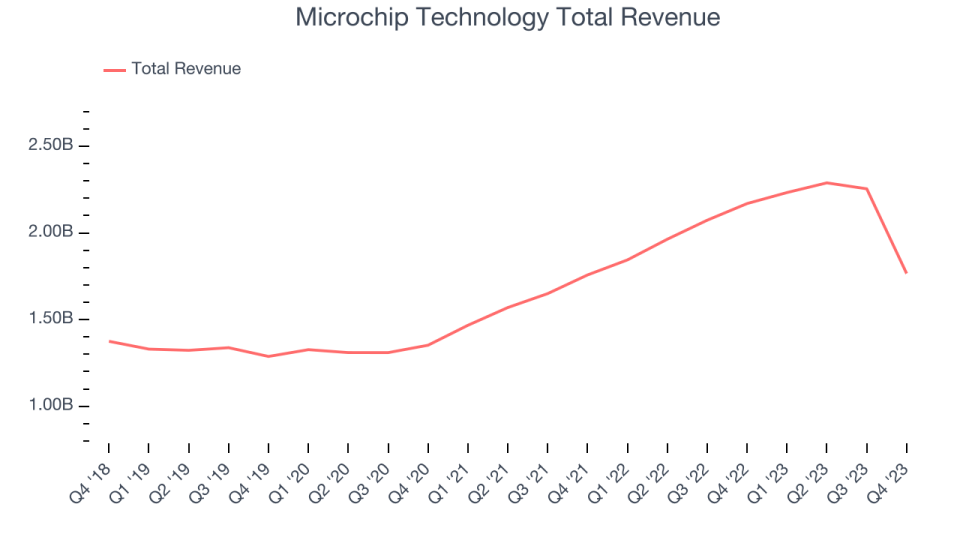

Microchip Know-how (NASDAQ:MCHP)

Spun out from Normal Instrument in 1987, Microchip Know-how (NASDAQ: MCHP) is a number one supplier of microcontrollers and built-in circuits used primarily within the automotive world, particularly in electrical autos and their charging units.

Microchip Know-how reported revenues of $1.77 billion, down 18.6% 12 months on 12 months, according to analyst expectations. It was a weak quarter for the corporate, with underwhelming income steering for the following quarter and a rise in its stock ranges.

“Our December quarter efficiency fell in need of our November steering, primarily as a result of weaker enterprise circumstances,” stated Ganesh Moorthy, President and Chief Government Officer.

The inventory is up 2.6% because the outcomes and presently trades at $87.84.

Read our full report on Microchip Technology here, it’s free.

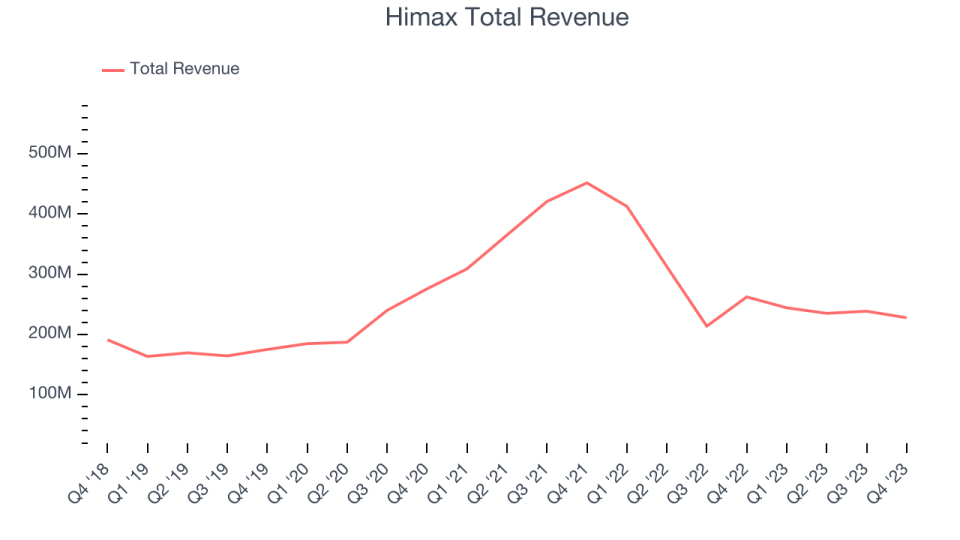

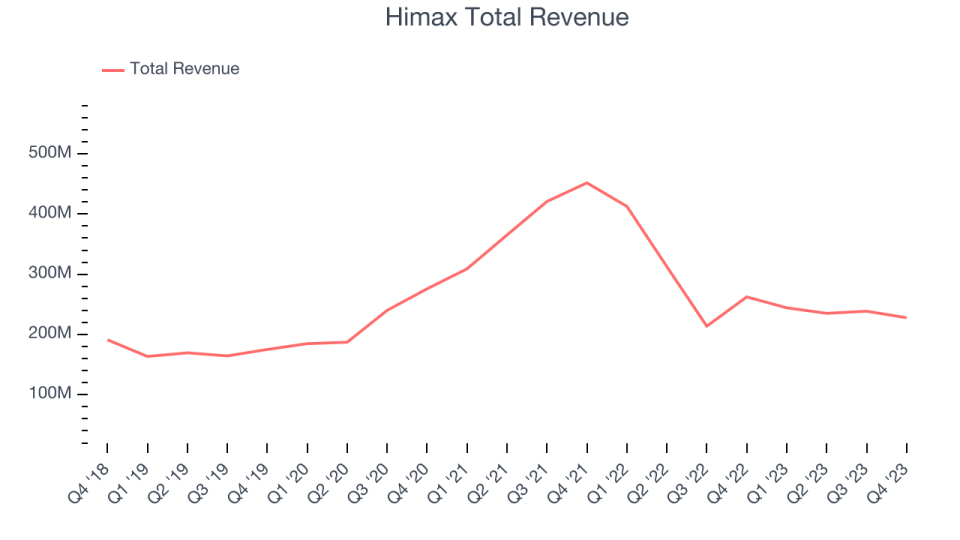

Greatest This fall: Himax (NASDAQ:HIMX)

Taiwan-based Himax Applied sciences (NASDAQ:HIMX) is a number one producer of show driver chips and timing controllers utilized in TVs, laptops, and cellphones.

Himax reported revenues of $227.7 million, down 13.2% 12 months on 12 months, according to analyst expectations. It was a really sturdy quarter for the corporate, with a major enchancment in its stock ranges.

The inventory is down 3.6% because the outcomes and presently trades at $5.44.

Is now the time to purchase Himax? Access our full analysis of the earnings results here, it’s free.

Weakest This fall: Texas Devices (NASDAQ:TXN)

Headquartered in Dallas, Texas because the Nineteen Fifties, Texas Devices (NASDAQ:TXN) is the world’s largest producer of analog semiconductors.

Texas Devices reported revenues of $4.08 billion, down 12.7% 12 months on 12 months, falling in need of analyst expectations by 1.4%. It was a weak quarter for the corporate, with underwhelming income steering for the following quarter and a miss of analysts’ income estimates.

The inventory is down 1.3% because the outcomes and presently trades at $172.06.

Read our full analysis of Texas Instruments’s results here.

Magnachip (NYSE:MX)

With its know-how present in frequent client electronics akin to TVs and smartphones, Magnachip Semiconductor (NYSE:MX) is a supplier of analog and mixed-signal semiconductors.

Magnachip reported revenues of $50.82 million, down 16.7% 12 months on 12 months, falling in need of analyst expectations by 3.1%. It was a weak quarter for the corporate, with underwhelming income steering for the following quarter. As well as, its income and free money movement missed analysts’ estimates, pushed by weak point in its industrial and automotive finish markets.

Magnachip had the weakest efficiency in opposition to analyst estimates amongst its friends. The inventory is down 18.9% because the outcomes and presently trades at $5.42.

Read our full, actionable report on Magnachip here, it’s free.

MACOM (NASDAQ:MTSI)

Based within the Nineteen Fifties as Microwave Associates, a communications provider to the US Military Sign Corp, at the moment MACOM Know-how Options (NASDAQ: MTSI) is a supplier of analog chips utilized in optical, wi-fi, and satellite tv for pc networks.

MACOM reported revenues of $157.1 million, down 12.7% 12 months on 12 months, surpassing analyst expectations by 2.9%. It was a blended quarter for the corporate, with income steering for subsequent quarter exceeding analysts’ expectations. Alternatively, its working margin fell, its gross margin shrunk, and its EPS steering for subsequent quarter underwhelmed.

MACOM scored the most important analyst estimates beat amongst its friends. The inventory is up 12.1% because the outcomes and presently trades at $96.67.

Read our full, actionable report on MACOM here, it’s free.

Be a part of Paid Inventory Investor Analysis

Assist us make StockStory extra useful to buyers like your self. Be a part of our paid person analysis session and obtain a $50 Amazon reward card to your opinions. Sign up here.