To keep away from investing in a enterprise that is in decline, there’s a couple of monetary metrics that may present early indications of getting older. Once we see a declining return on capital employed (ROCE) along side a declining base of capital employed, that is typically how a mature enterprise exhibits indicators of getting older. Finally because of this the corporate is incomes much less per greenback invested and on prime of that, it is shrinking its base of capital employed. On that be aware, trying into Melco Resorts & Leisure (NASDAQ:MLCO), we weren’t too upbeat about how issues had been going.

Understanding Return On Capital Employed (ROCE)

Simply to make clear if you happen to’re not sure, ROCE is a metric for evaluating how a lot pre-tax earnings (in share phrases) an organization earns on the capital invested in its enterprise. Analysts use this formulation to calculate it for Melco Resorts & Leisure:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Property – Present Liabilities)

0.038 = US$273m ÷ (US$8.3b – US$1.1b) (Primarily based on the trailing twelve months to December 2023).

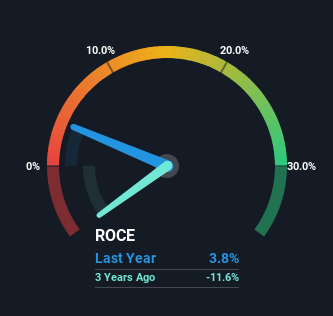

Thus, Melco Resorts & Leisure has an ROCE of three.8%. Finally, that is a low return and it under-performs the Hospitality trade common of 9.6%.

View our latest analysis for Melco Resorts & Entertainment

Above you possibly can see how the present ROCE for Melco Resorts & Leisure compares to its prior returns on capital, however there’s solely a lot you possibly can inform from the previous. If you would like to see what analysts are forecasting going ahead, you must try our free analyst report for Melco Resorts & Entertainment .

How Are Returns Trending?

By way of Melco Resorts & Leisure’s historic ROCE actions, the development does not encourage confidence. About 5 years in the past, returns on capital had been 8.8%, nevertheless they’re now considerably decrease than that as we noticed above. On prime of that, it is price noting that the quantity of capital employed throughout the enterprise has remained comparatively regular. Since returns are falling and the enterprise has the identical quantity of belongings employed, this will recommend it is a mature enterprise that hasn’t had a lot development within the final 5 years. If these traits proceed, we would not count on Melco Resorts & Leisure to show right into a multi-bagger.

On a facet be aware, Melco Resorts & Leisure has completed nicely to pay down its present liabilities to 13% of complete belongings. So we might hyperlink a few of this to the lower in ROCE. Successfully this implies their suppliers or short-term collectors are funding much less of the enterprise, which reduces some components of danger. Some would declare this reduces the enterprise’ effectivity at producing ROCE since it’s now funding extra of the operations with its personal cash.

Our Take On Melco Resorts & Leisure’s ROCE

All in all, the decrease returns from the identical quantity of capital employed aren’t precisely indicators of a compounding machine. Unsurprisingly then, the inventory has dived 72% over the past 5 years, so buyers are recognizing these adjustments and don’t love the corporate’s prospects. That being the case, except the underlying traits revert to a extra constructive trajectory, we might contemplate trying elsewhere.

On a separate be aware, we have discovered 1 warning sign for Melco Resorts & Entertainment you may most likely wish to find out about.

Whereas Melco Resorts & Leisure is not incomes the very best return, try this free list of companies that are earning high returns on equity with solid balance sheets.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by basic knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.