[ad_1]

At a time when the worldwide euphoria about AI has propelled a three-fold surge in Nvidia Corp. and a 50% bounce in a key US index for semiconductor producers in lower than a yr, buyers are pointing towards rising markets for higher worth and a much bigger pool of choices.

The asset administration arm of Goldman Sachs Group Inc. mentioned it’s trying particularly for stakes within the producers of AI supply-chain elements, reminiscent of cooling techniques and energy provides. JPMorgan Asset Administration favors conventional producers of electronics which might be morphing into AI leaders, whereas funding managers at Morgan Stanley are betting on gamers the place AI is reshaping enterprise fashions in non-tech sectors.

“We see AI as a progress driver in rising markets,” mentioned Jitania Kandhari, deputy chief funding officer at Morgan Stanley Funding Administration. “Whereas we now have beforehand invested in direct AI beneficiaries like semiconductors, going ahead it is going to be key to search for firms in numerous industries which might be adopting AI to reinforce earnings.”

AI shares are already main a $1.9 trillion rebound in rising markets this yr, with Taiwanese and South Korean chip firms reminiscent of Taiwan Semiconductor Manufacturing Co. and SK Hynix Inc. accounting for 90% of the features, in accordance with knowledge compiled by Bloomberg.

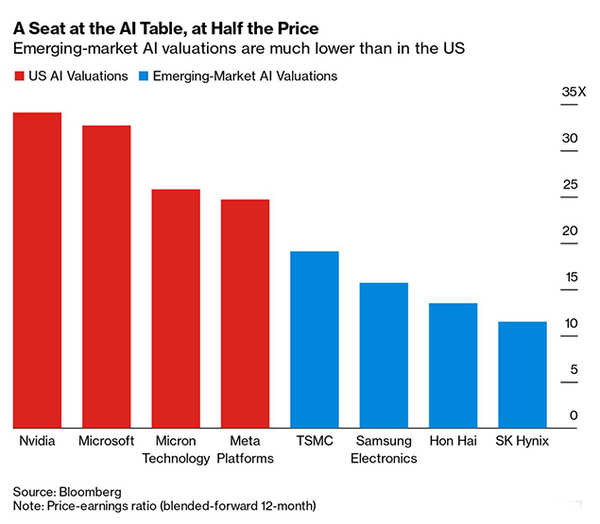

Regardless of this rally, most emerging-market AI shares nonetheless supply much better worth than their US friends. Whereas Nvidia trades at 35 instances its projected earnings, Asian AI giants are usually valued between 12 and 19 instances.

Creating markets additionally supply quicker progress. Analysts see a 61% enhance in earnings for emerging-market know-how firms as a complete, in comparison with the 20% rise that they had been penciling in for US friends, in accordance with knowledge compiled by Bloomberg.

To this point, the celebrities of the present are these firms which already had been know-how leaders previous to the AI rally, reminiscent of TSMC and Hon Hai Precision Business Co.

The duo and MediaTek Inc., additionally a chipmaker, function in a JPMorgan single-country fund that invests in Taiwanese equities and has outperformed 96% of greater than 1,400 friends. The three shares are additionally among the many top-10 holdings of the iShare MSCI EM Ex-China ETF, which has doubled in worth over the previous 5 months.

“The tech firms which have traditionally been the suppliers to the large names, could effectively emerge as the large gamers themselves,” mentioned Anuj Arora, head of rising markets and Asia Pacific equities at JPMorgan Asset Administration. “The early adaption of this know-how means these firms are far forward of their opponents in leveraging newer evolutions.”

Nonetheless, the excitement is widening and extra buyers are pouring in cash.

For instance, Korea’s Hanmi Semiconductor Co., majority-owned by billionaire Kwak Dong Shin’s household, has surged about 120% this yr for the very best features amongst members of the MSCI Rising Markets Index. It as additionally seen its share of international possession enhance in latest weeks, in accordance with knowledge compiled by Bloomberg.

In Vietnam, IT providers supplier FPT Corp. has jumped nearly 20% this yr, lifting the Ashmore EM Frontier Fairness Fund as the very best performer amongst actively managed rising market funds within the US.

For EM-focused exchange-traded funds, greater than half of all inflows this yr have gone into the iShares MSCI EM ex-China ETF, whose high 10 holdings embody firms which might be investing in AI, in accordance with knowledge compiled by Bloomberg.

Elsewhere, established companies have attracted recent investor curiosity after signaling that they’re transferring into AI.

Saudi Arabia is changing into a hotbed for Chinese language AI ventures, such Alibaba Group Holding Ltd.’s cloud partnership with Saudi Telecom Co.

India’s Reliance Industries Ltd., the petroleum big run by billionaire Mukesh Ambani, has developed a chatGPT-style mannequin with capabilities in 22 Indian languages. The corporate can be a part of the digital transformation within the nation of 1.4 billion individuals.

“We might level to the potential ‘nationwide champions’ mindset that’s growing round AI in some markets,” mentioned Luke Barrs, world head of elementary fairness shopper portfolio administration at Goldman Sachs. “Nations are targeted on fostering homegrown firms that may be future leaders.”

The commerce isn’t with out its dangers.

Rising markets are tied intently to the US, which means that an AI selloff may echo the world over. Alternatively, if stock-market features broaden out, then different sectors could catch up and AI names may lag behind.

Nonetheless, buyers are more and more discovering EM alternate options to US tech shares which have over-extended themselves, mentioned Morgan Stanley’s Kandhari.

“In rising markets, they’re seeing AI as an under-appreciated driver going ahead,” she mentioned. “There’s lots of low-hanging fruit to juice there.”

[ad_2]

Source link