[ad_1]

Key Insights

-

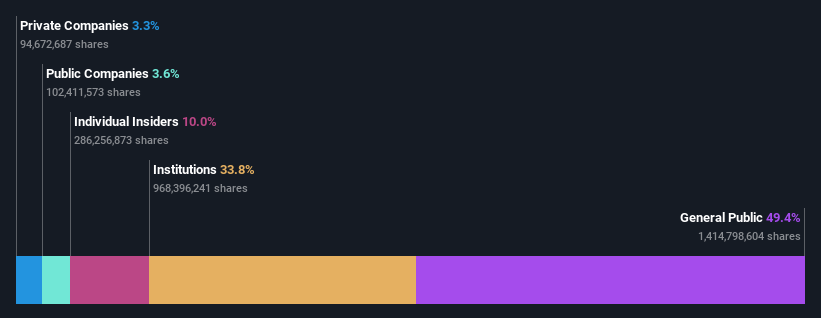

Star Leisure Group’s vital retail traders possession means that the important thing choices are influenced by shareholders from the bigger public

-

A complete of 25 traders have a majority stake within the firm with 50% possession

Each investor in The Star Leisure Group Restricted (ASX:SGR) ought to concentrate on essentially the most highly effective shareholder teams. With 49% stake, retail traders possess the utmost shares within the firm. That’s, the group stands to profit essentially the most if the inventory rises (or lose essentially the most if there’s a downturn).

Whereas establishments who personal 34% got here underneath stress after market cap dropped to AU$1.5b final week,retail traders took essentially the most losses.

Let’s take a more in-depth look to see what the various kinds of shareholders can inform us about Star Leisure Group.

Check out our latest analysis for Star Entertainment Group

What Does The Institutional Possession Inform Us About Star Leisure Group?

Institutional traders generally evaluate their very own returns to the returns of a generally adopted index. So they often do think about shopping for bigger firms which can be included within the related benchmark index.

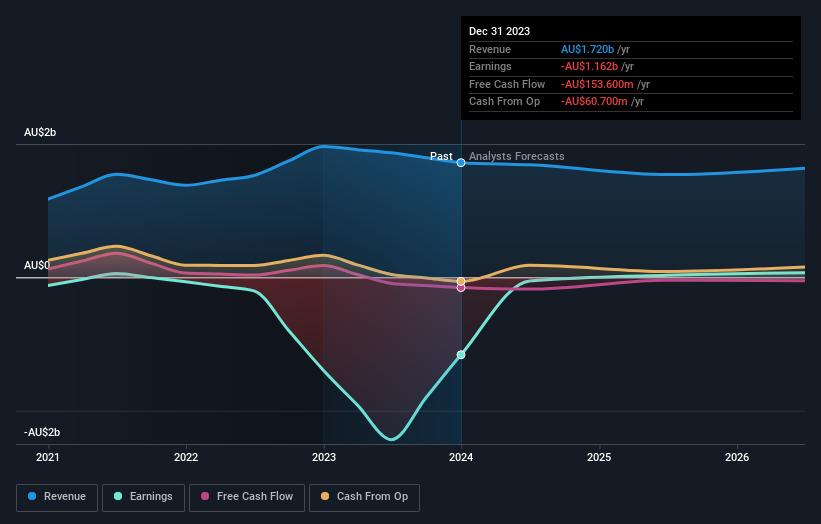

We will see that Star Leisure Group does have institutional traders; and so they maintain a superb portion of the corporate’s inventory. This means the analysts working for these establishments have seemed on the inventory and so they prefer it. However similar to anybody else, they could possibly be mistaken. If a number of establishments change their view on a inventory on the similar time, you would see the share value drop quick. It is due to this fact price taking a look at Star Leisure Group’s earnings historical past beneath. In fact, the long run is what actually issues.

Star Leisure Group will not be owned by hedge funds. our information, we will see that the biggest shareholder is Bruce Mathieson with 8.2% of shares excellent. For context, the second largest shareholder holds about 7.3% of the shares excellent, adopted by an possession of 5.1% by the third-largest shareholder.

On learning our possession information, we discovered that 25 of the highest shareholders collectively personal lower than 50% of the share register, implying that no single particular person has a majority curiosity.

Whereas it is sensible to review institutional possession information for an organization, it additionally is sensible to review analyst sentiments to know which method the wind is blowing. Fairly a couple of analysts cowl the inventory, so you would look into forecast development fairly simply.

Insider Possession Of Star Leisure Group

The definition of firm insiders could be subjective and does differ between jurisdictions. Our information displays particular person insiders, capturing board members on the very least. Administration finally solutions to the board. Nonetheless, it’s not unusual for managers to be government board members, particularly if they’re a founder or the CEO.

Most think about insider possession a optimistic as a result of it could point out the board is nicely aligned with different shareholders. Nonetheless, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date information signifies that insiders personal some shares in The Star Leisure Group Restricted. The insiders have a significant stake price AU$152m. Most would see this as an actual optimistic. If you want to discover the query of insider alignment, you’ll be able to click here to see if insiders have been buying or selling.

Common Public Possession

Most of the people, who’re normally particular person traders, maintain a 49% stake in Star Leisure Group. Whereas this group cannot essentially name the pictures, it could actually have an actual affect on how the corporate is run.

Non-public Firm Possession

Our information signifies that Non-public Firms maintain 3.3%, of the corporate’s shares. Non-public firms could also be associated events. Generally insiders have an curiosity in a public firm via a holding in a non-public firm, fairly than in their very own capability as a person. Whereas it is arduous to attract any broad stroke conclusions, it’s price noting as an space for additional analysis.

Public Firm Possession

It seems to us that public firms personal 3.6% of Star Leisure Group. We will not make sure however it’s fairly doable it is a strategic stake. The companies could also be comparable, or work collectively.

Subsequent Steps:

I discover it very attention-grabbing to have a look at who precisely owns an organization. However to really acquire perception, we have to think about different info, too. As an illustration, we have recognized 1 warning sign for Star Entertainment Group that you have to be conscious of.

However finally it’s the future, not the previous, that can decide how nicely the homeowners of this enterprise will do. Subsequently we expect it advisable to check out this free report showing whether analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing information from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be in step with full yr annual report figures.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We purpose to deliver you long-term centered evaluation pushed by basic information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link