[ad_1]

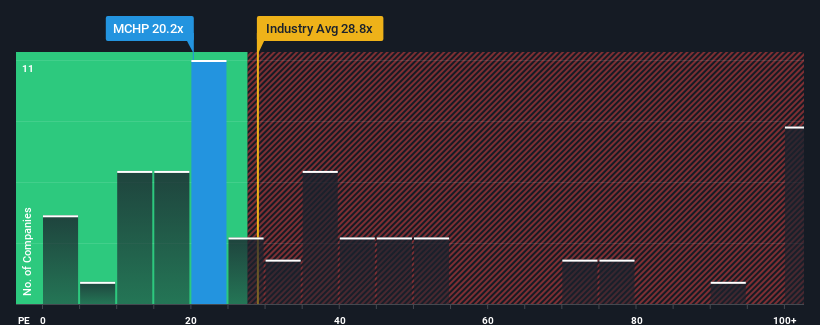

With a price-to-earnings (or “P/E”) ratio of 20.2x Microchip Know-how Included (NASDAQ:MCHP) could also be sending bearish alerts in the meanwhile, given that nearly half of all corporations in the USA have P/E ratios below 16x and even P/E’s decrease than 9x are usually not uncommon. Though, it isn’t sensible to only take the P/E at face worth as there could also be an reason why it is as excessive as it’s.

With its earnings progress in optimistic territory in comparison with the declining earnings of most different corporations, Microchip Know-how has been doing fairly properly of late. Evidently many expect the corporate to proceed defying the broader market adversity, which has elevated traders’ willingness to pay up for the inventory. If not, then present shareholders is perhaps a little bit nervous in regards to the viability of the share value.

See our latest analysis for Microchip Technology

Eager to learn how analysts assume Microchip Know-how’s future stacks up towards the trade? In that case, our free report is a great place to start.

Is There Sufficient Development For Microchip Know-how?

The one time you would be really snug seeing a P/E as excessive as Microchip Know-how’s is when the corporate’s progress is on observe to outshine the market.

Having a look again first, we see that the corporate grew earnings per share by a powerful 16% final yr. The most recent three yr interval has additionally seen a superb 559% general rise in EPS, aided by its short-term efficiency. So we are able to begin by confirming that the corporate has completed a terrific job of rising earnings over that point.

Shifting to the long run, estimates from the analysts masking the corporate recommend earnings ought to develop by 1.1% every year over the subsequent three years. With the market predicted to ship 10% progress per yr, the corporate is positioned for a weaker earnings end result.

In mild of this, it is alarming that Microchip Know-how’s P/E sits above the vast majority of different corporations. Apparently many traders within the firm are far more bullish than analysts point out and are not prepared to let go of their inventory at any value. There is a good likelihood these shareholders are setting themselves up for future disappointment if the P/E falls to ranges extra consistent with the expansion outlook.

The Key Takeaway

Utilizing the price-to-earnings ratio alone to find out for those who ought to promote your inventory is not wise, nevertheless it may be a sensible information to the corporate’s future prospects.

Our examination of Microchip Know-how’s analyst forecasts revealed that its inferior earnings outlook is not impacting its excessive P/E anyplace close to as a lot as we might have predicted. After we see a weak earnings outlook with slower than market progress, we suspect the share value is liable to declining, sending the excessive P/E decrease. This locations shareholders’ investments at important danger and potential traders in peril of paying an extreme premium.

There are additionally different important danger components to contemplate and we have found 3 warning signs for Microchip Technology (1 is important!) that you ought to be conscious of earlier than investing right here.

It is vital to be sure to search for a terrific firm, not simply the primary concept you come throughout. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Microchip Know-how is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by basic knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link