Globetronics Expertise Bhd (KLSE:GTRONIC) has had a tough three months with its share value down 13%. Nonetheless, the corporate’s fundamentals look fairly respectable, and long-term financials are normally aligned with future market value actions. Particularly, we determined to review Globetronics Technology Bhd’s ROE on this article.

Return on fairness or ROE is a crucial issue to be thought-about by a shareholder as a result of it tells them how successfully their capital is being reinvested. In brief, ROE reveals the revenue every greenback generates with respect to its shareholder investments.

Check out our latest analysis for Globetronics Technology Bhd

How To Calculate Return On Fairness?

The components for ROE is:

Return on Fairness = Web Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above components, the ROE for Globetronics Expertise Bhd is:

8.6% = RM26m ÷ RM308m (Based mostly on the trailing twelve months to December 2023).

The ‘return’ is the earnings the enterprise earned over the past 12 months. That signifies that for each MYR1 price of shareholders’ fairness, the corporate generated MYR0.09 in revenue.

Why Is ROE Essential For Earnings Progress?

Thus far, we have realized that ROE is a measure of an organization’s profitability. Based mostly on how a lot of its income the corporate chooses to reinvest or “retain”, we’re then capable of consider an organization’s future potential to generate income. Assuming every thing else stays unchanged, the upper the ROE and revenue retention, the upper the expansion price of an organization in comparison with firms that do not essentially bear these traits.

Globetronics Expertise Bhd’s Earnings Progress And eight.6% ROE

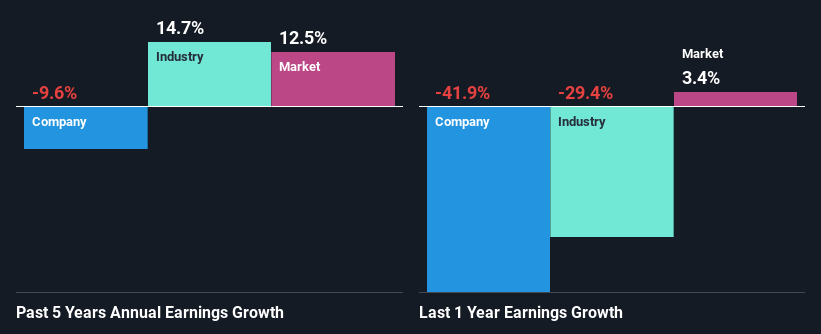

On the face of it, Globetronics Expertise Bhd’s ROE isn’t a lot to speak about. Though a more in-depth research reveals that the corporate’s ROE is increased than the business common of seven.0% which we undoubtedly cannot overlook. However seeing Globetronics Expertise Bhd’s 5 12 months web earnings decline of 9.6% over the previous 5 years, we’d rethink that. Keep in mind, the corporate does have a barely low ROE. It’s simply that the business ROE is decrease. Due to this fact, the decline in earnings is also the results of this.

Nonetheless, once we in contrast Globetronics Expertise Bhd’s progress with the business we discovered that whereas the corporate’s earnings have been shrinking, the business has seen an earnings progress of 15% in the identical interval. That is fairly worrisome.

Earnings progress is a big consider inventory valuation. It’s necessary for an investor to know whether or not the market has priced within the firm’s anticipated earnings progress (or decline). This then helps them decide if the inventory is positioned for a vibrant or bleak future. Is Globetronics Expertise Bhd pretty valued in comparison with different firms? These 3 valuation measures would possibly provide help to resolve.

Is Globetronics Expertise Bhd Making Environment friendly Use Of Its Earnings?

its three-year median payout ratio of 40% (or a retention ratio of 60%) which is fairly regular, Globetronics Expertise Bhd’s declining earnings is somewhat baffling as one would count on to see a good bit of progress when an organization is retaining an excellent portion of its income. So there might be another explanations in that regard. For example, the corporate’s enterprise could also be deteriorating.

Moreover, Globetronics Expertise Bhd has paid dividends over a interval of at the least ten years, which signifies that the corporate’s administration is decided to pay dividends even when it means little to no earnings progress. Upon learning the newest analysts’ consensus information, we discovered that the corporate’s future payout ratio is anticipated to rise to 72% over the subsequent three years. Nonetheless, Globetronics Expertise Bhd’s future ROE is anticipated to rise to fifteen% regardless of the anticipated improve within the firm’s payout ratio. We infer that there might be different components that might be driving the anticipated progress within the firm’s ROE.

Conclusion

Total, we really feel that Globetronics Expertise Bhd actually does have some optimistic components to think about. But, the low earnings progress is a bit regarding, particularly provided that the corporate has a good price of return and is reinvesting an enormous portion of its income. By the appears of it, there might be another components, not essentially in charge of the enterprise, that is stopping progress. With that mentioned, we studied the newest analyst forecasts and located that whereas the corporate has shrunk its earnings previously, analysts count on its earnings to develop sooner or later. To know extra concerning the newest analysts predictions for the corporate, take a look at this visualization of analyst forecasts for the company.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term centered evaluation pushed by basic information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.