Baker Expertise Restricted’s (SGX:BTP) periodic dividend will probably be growing on the twenty first of Might to SGD0.015, with traders receiving 50% greater than final 12 months’s SGD0.01. The fee will take the dividend yield to 2.5%, which is in keeping with the common for the trade.

View our latest analysis for Baker Technology

Baker Expertise’s Earnings Simply Cowl The Distributions

We aren’t too impressed by dividend yields until they are often sustained over time. Nevertheless, previous to this announcement, Baker Expertise’s dividend was comfortably lined by each money move and earnings. Which means that most of its earnings are being retained to develop the enterprise.

Trying ahead, EPS may fall by 13.8% if the corporate cannot flip issues round from the previous couple of years. If the dividend continues alongside the trail it has been on just lately, we estimate the payout ratio might be 32%, which is certainly possible to proceed.

Dividend Volatility

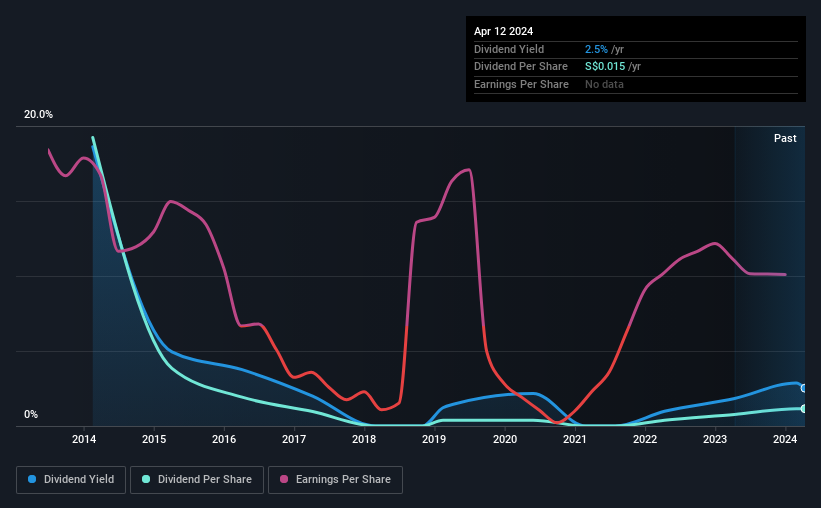

Whereas the corporate has been paying a dividend for a very long time, it has minimize the dividend at the very least as soon as within the final 10 years. The annual fee over the last 10 years was SGD0.25 in 2014, and the latest fiscal 12 months fee was SGD0.015. The dividend has fallen 94% over that interval. Declining dividends is not typically what we search for as they will point out that the corporate is working into some challenges.

The Dividend Has Restricted Development Potential

Provided that the observe file hasn’t been stellar, we actually wish to see earnings per share rising over time. Baker Expertise’s EPS has fallen by roughly 14% per 12 months throughout the previous 5 years. A pointy decline in earnings per share is just not nice from from a dividend perspective. Even conservative payout ratios can come underneath strain if earnings fall far sufficient.

Our Ideas On Baker Expertise’s Dividend

In abstract, whereas it is at all times good to see the dividend being raised, we do not suppose Baker Expertise’s funds are rock stable. The corporate is producing loads of money, which may keep the dividend for some time, however the observe file hasn’t been nice. We might be a contact cautious of counting on this inventory primarily for the dividend earnings.

Firms possessing a secure dividend coverage will seemingly get pleasure from higher investor curiosity than these affected by a extra inconsistent method. Nonetheless, traders want to think about a number of different components, other than dividend funds, when analysing an organization. For example, we have recognized 2 warning signs for Baker Technology that you have to be conscious of earlier than investing. Is Baker Expertise not fairly the chance you have been in search of? Why not take a look at our selection of top dividend stocks.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by elementary knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.